Share Your Success: Make an Impact with a Stock Donation

Support The Dandelion Philosophy and benefit from a tax-efficient, impactful way to give

- Maximise Your Tax Savings: Avoid capital gains tax on appreciated stock

- Reduce Your Taxable Income: Deduct the full market value of your stock donation

- Create Lasting Impact: Your donation supports life-changing projects and community initiatives

Why Choose Stock Donations?

Donating stock to The Dandelion Philosophy offers significant benefits for you as a donor. First, it's tax-efficient: when you donate appreciated stock directly to charity, you avoid capital gains taxes that you would otherwise incur if you sold the stock. This allows you to donate the full value of the stock, maximizing the impact of your gift. Additionally, you may be eligible for a charitable deduction based on the fair market value of the stock, which can reduce your income tax. Your contribution helps us further our mission and increases the positive impact we can make together.

3 Simple Steps to Donate Stock

Making a stock donation is easier than you think. Follow these three simple steps to get started.

Steps

- Contact Your Broker: Instruct them to transfer shares to The Dandelion Philosophy

- Notify Us: Complete our stock donation form to inform us of your gift

- Receive a Tax Receipt: We’ll send a confirmation and tax receipt once processed

Tax Benefits of Donating Appreciated Stock

Two primary tax benefits:

- Avoiding capital gains tax

- Claiming a charitable deduction on the full market value

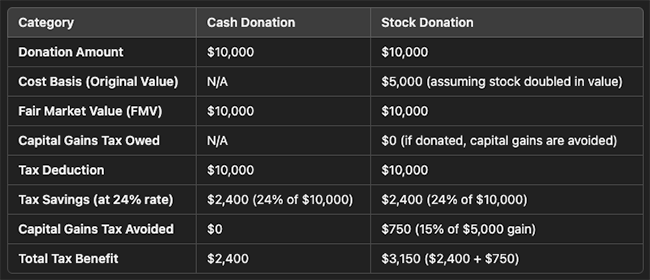

Here’s a simple table comparing the tax impact of a cash donation versus a stock donation assuming both donations are valued at $10,000, and the stock has appreciated in value:

Summary:

- Cash Donation: Provides a straightforward tax deduction of $10,000, resulting in tax savings of $2,400 at a 24% tax rate.

- Stock Donation: Not only provides the same $2,400 tax savings from the deduction but also avoids capital gains tax, which saves an additional $750 (assuming a 15% capital gains tax rate on a $5,000 gain).

The total benefit of donating appreciated stock is higher due to the additional capital gains tax savings.

* This example is for informational purposes only. Please consult a tax advisor to understand the specific benefits of a stock donation based on your financial situation

Your Donation Powers Positive Change

Donating appreciated stock allows individuals to maximize their charitable giving, enabling organizations to receive the full market value of the asset without the donor paying capital gains taxes. This increased financial contribution empowers nonprofits to direct more resources toward their mission, driving greater social impact. With larger, tax-efficient donations, organizations can expand their programs, reach more communities, and accelerate the positive change they aim to create in society.

Education Initiatives

Community Development

Health and Wellbeing

What Our Donors Say

Frequently Asked Questions

-

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

-

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

-

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Links

* Disclaimer: The tax benefits of donating appreciated stock can vary based on individual circumstances, including income level, holding period, and current tax laws. Donors are encouraged to consult with a qualified tax advisor to fully understand how a stock donation may impact their personal tax situation and to ensure they maximize their potential benefits.

Get in Touch with The Dandelion Philosophy

Or Contact Us Directly

Call Us

South Africa +27 (0) 606 454 567

United Kingdom +44 (0) 7517 176 240

United States +1 (872) 295-6365